EIDL Loan 2021 - SBA Grant for Small Business Application $10k to 150k

EIDL Loan 2021 - SBA Grant for Small Business Application $10k to 150k

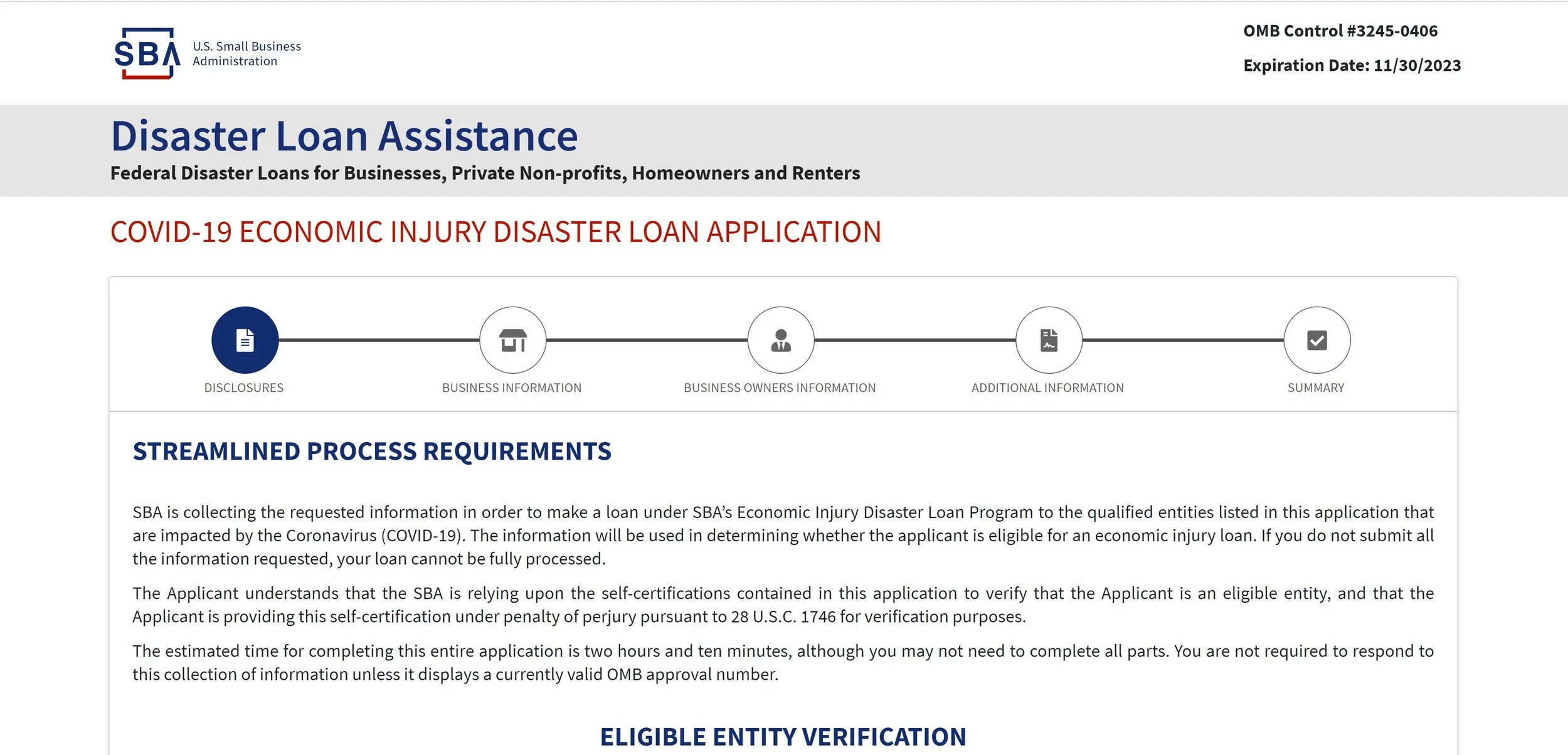

The SBA grant/EIDL loan is back! EIDL is short for Economic Injury Disaster Loan. For the applicants who have applied for it in 2020, the application process and questionnaires for the loan are still the same. If you missed the opportunity last year and are applying for the first time, here are all the things you need to know:

1. EIDL loan application website:

2. Files you need before you start (Same as 2020):

1) Income statement

Gross revenue amount from Jan 2019 to Jan 2020 (12 months)

Cost of goods sold amount from Jan 2019 to Jan 2020 (12 months)

2) Number of employees for your company, as of January 31, 2020

3) Date business established

4) EIN

3. The basics of the EIDL loan 2021 (Same as 2020):

Advance amount: $1,000 per employee ( NO LONGER AVAILABLE)

The advance amount will be forgiven

The actual loan will need to be paid back

4. The advance portion of the loan (NO LONGER AVAILABLE):

The advance portion of the loan does not have to be repaid and is forgiven. For business owners who have applied for the loan in 2020, you might remember that a cash deposit from the SBA magically appeared in your bank account one day. That was the advance portion of the loan.

What determines how much advance loan you get from the SBA? It is $1,000 per employee for the advance, and it is capped at $10,000 maximum.

For example, if you have 12 employees, the advance loan amount you will get is the maximum amount, which is $10,000. If you have 2 employees, you will get $2,000 in advance.

Update according to SBA website:

All available funds for the EIDL Advance program have been allocated. SBA is not able to issue EIDL Advances once program funding has been obligated and is no longer available.

EIDL loan applications will still be processed even though the Advance is no longer available.

5. The actual loan:

The actual loan is a 30 year loan with 3.75% interest annually. After the advance loan is deposited into your bank account, you then can apply for the actual loan.

Based on last year, it is very likely the SBA will send out emails to loan applicants and ask them to create an account on the SBA’s website to apply for the actual loan.

On the website, you will see the maximum loan amount you can borrow from the SBA. You have the option to choose how much you want to borrow, however, the maximum amount of the loan has been predetermined by the SBA. The SBA’s website makes it very clear that submitting the loan application doesn’t guarantee that you will get the loan, and you will need to wait for approval to find out the result.

Remember, the actual loan needs to be repaid. It is a 30 year loan with an interest rate of 3.75% for for-profit businesses and 2.75% for non-profits. You will need to start repaying the loan 12 months after the closing of the loan.

Takeaway:

The EIDL loan is a combination of an advance loan which will be forgiven, and an actual loan, which has a 30 year term and a 3.75% interest rate. After being approved by the SBA, you can then choose the amount of loan to borrow, depending on your operational costs.

We, Advisori Finance, don’t assist with completing the application; however, if you have questions about your Income Statements, let us know!