EIDL Loan - The Free $10,000 Grant and Everything You Need To Know

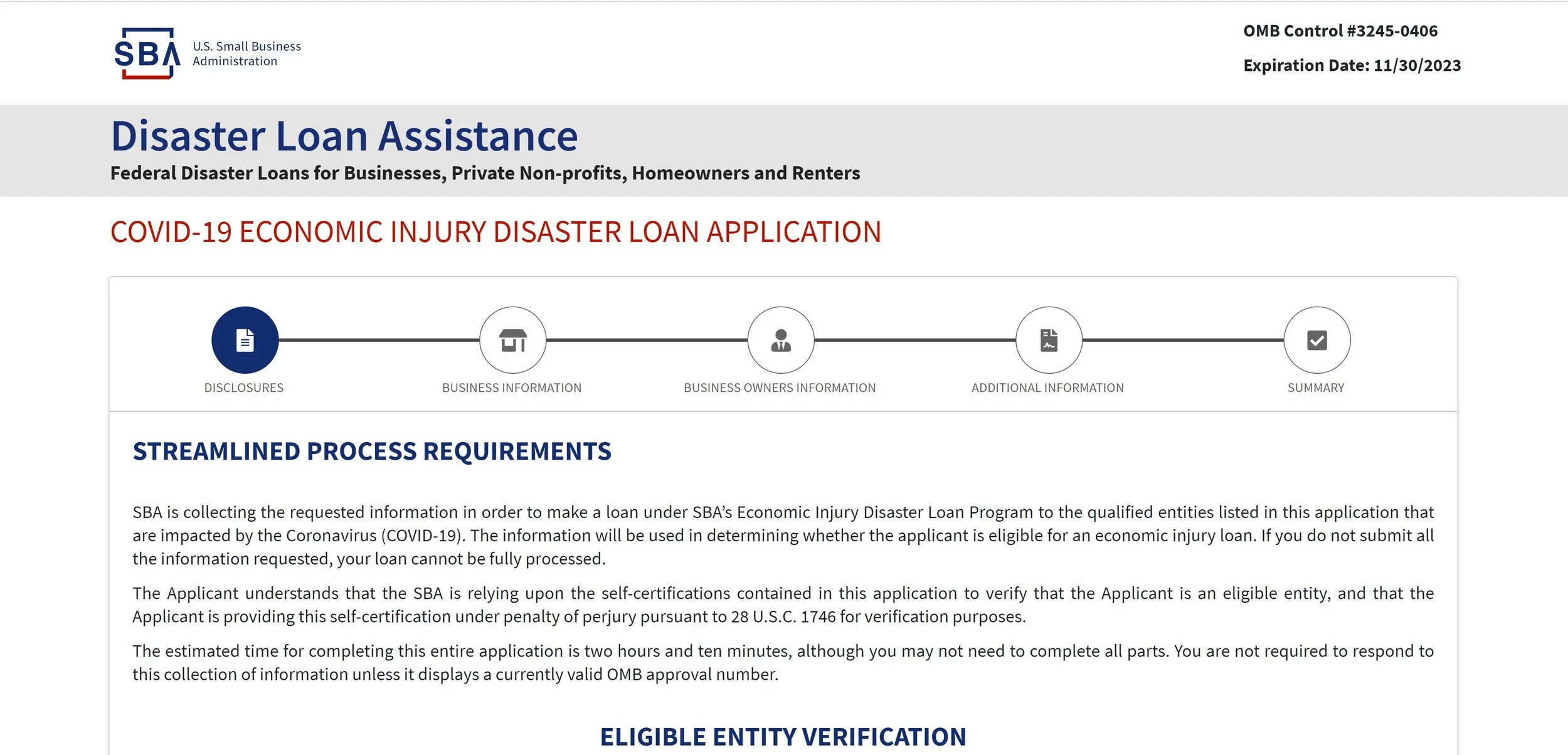

Are you wondering how the EIDL loan works and need more information before applying for it? As the SBA is rolling out more guidance on the loan application, we continue to learn more about the EIDL loan and what the criteria are for loan forgiveness. According to the SBA website, as of May 30, 2020, 707.6K EIDL loan applications have been approved nation-wide, and $55.79 billion in loans have been distributed.

To help you save time researching, I have highlighted the key terms about the EIDL loan that might not otherwise be obvious on the SBA’s website. Here are the facts you will need to know when applying for the EIDL loan:

EIDL is short for Economic Injury Disaster Loan. Very different from most loans, this loan has two components:

1. The advance (forgiven)

2. The actual loan (to be paid back)

Let’s dig in more on the details:

1. Advance amount: $1,000 per employee.

The advance portion of the loan does not have to be repaid and is forgiven. For business owners who have applied for the loan, you may have seen that a cash deposit from the SBA magically appeared in your bank account one day. That was the advance portion of the loan.

What determines how much advance loan you can get from the SBA? You get $1,000 per employee for the loan, and it is capped at $10,000 maximum. For example, if you have 12 employees, the advance loan amount you will get is the maximum amount, which is $10,000. If you have 2 employees, you will get $2,000 in advance.

Keep in mind, the advance loan does not need to be repaid. It is completely free to you.

2. The actual loan is a 30 year loan with 3.75% interest annually.

After the advance loan is deposited into your bank account, you then can apply for the actual loan. For the past few weeks, the SBA has been sending out emails to loan applicants and asking them to create an account on the SBA’s website to apply for the actual loan. On the website, you will see the maximum loan amount you can borrow from the SBA. You have the option to choose how much you want to borrow, however, the maximum amount of the loan has been predetermined by the SBA. The SBA’s website makes it very clear that submitting the loan application doesn’t guarantee that you will get the loan, and you will need to wait for approval to find out the result.

Remember, the actual loan needs to be repaid. It is a 30 year loan with an interest rate of 3.75% for for-profit businesses and 2.75% for non-profits. You will need to start repaying the loan 12 months after the closing of the loan.

As for the qualifications to apply for the loan, it is worth mentioning that if the business owner is not a US citizen or green card holder, your EIDL application might get denied. Before making a decision on granting the loan, one of the SBA loan officers will contact you for a copy of the business owner’s US passport or green card. If you fail to provide these documents, your loan application might be denied.

Takeaway

The EIDL loan is a combination of an advance loan which will be forgiven, and an actual loan, which has a 30 year term and a 3.75% interest rate. Depending on the amount of cash your business needs to cover operational costs, you can choose the appropriate loan amount to borrow from the SBA.

I hope this article answered all of your questions about the EIDL loan, but if not, we’d be happy to answer any additional questions you might have.