Startup Banking - QuickBooks Cash, a combination of banking and accounting

QuickBooks just announced its new feature, QuickBooks Cash, a brand new function to help business owners to manage cash, get deposits faster, and most importantly, link all the cash related functions together under one roof. This article is a repost from QuickBooks and you can find the original article here.

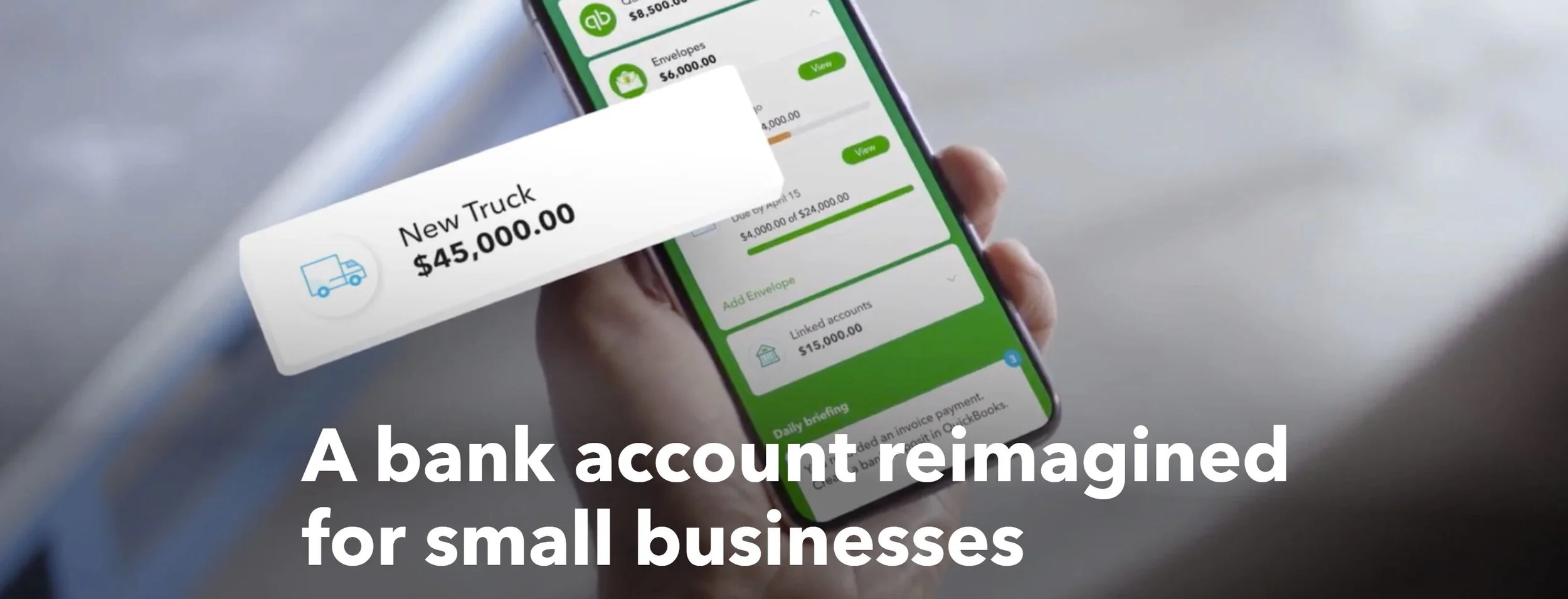

QuickBooks Cash is a business bank account with debit card that’s free to open, has no minimum balance or required daily balance and no monthly service fee. With free instant deposit for eligible users, there’s no more waiting for funds from payments processing to clear, which means no more latency math to figure out when you can pay your team or restock supplies. The money is ready when you are, and earns a truly high-yield interest — 25 times the industry average. And with the addition of QuickBooks Cash into the QuickBooks family, small business owners not only have access to an all-in-one business bank account but can also see their entire financial picture, pay employees and bills, accept payments and get access to capital — all from the same platform.

In traditional systems, money takes too much time to get where it needs to be. Here’s an example: Normally, a business can’t accept a payment and immediately have access to that money to run payroll the same day. Some systems can tack on a 1-to -2-day waiting period before a payment is deposited, and then customers need up to a week or more to run payroll, according to research conducted in 2019 by QuickBooks. But with the instant deposit feature in QuickBooks Cash working in tandem with QuickBooks Payroll — which can set-up and run payroll on the same day — the latency goes away and people can run their business in a timely fashion. When cash moves faster, businesses can grow faster. And with their full money picture in one place, businesses are better informed, and can make better financial decisions.

QuickBooks Cash arrives at a vital moment for small businesses: In the current COVID-19 environment, they need as much help as possible to gain faster access to — and keep track of — their money. And they need to do it remotely. Unlike the traditional small business bank account model, small business owners can sign up for QuickBooks Cash online from mobile or desktop, without ever having to go to a bank. Approval can take only a few minutes1. And, because machine-learning prediction is built into the system, small businesses can get predictive analysis of their upcoming 90-day cash flow, including when an invoice is likely to be paid. This provides critical information to help make decisions like whether to work on drumming up new business or collecting outstanding payments.

Using one platform that performs so many functions is more than just convenient. It can even save small businesses money in the end. By allowing small businesses to manage all the services that impact cash flow at once — from bill pay to payments, payroll and banking — there is the potential to eliminate fees and allow businesses to better understand, manage and predict their cash flow trajectory. QuickBooks Cash combines the capabilities of varying services — ranging from payments to cash flow planning to banking — into one core service, potentially saving customers money by eliminating service fees and increasing efficiency when managing their business.

QuickBooks Cash will include:

QuickBooks Cash: A business bank account that allows small businesses to fully manage their finances, access their cash and earn interest. QuickBooks Cash is free to open, and it has no minimum opening deposit or daily balance requirements and no monthly service fees2.

QuickBooks Debit Card: A physical debit card that enables a small business to spend from its QuickBooks Cash balance. It reconciles seamlessly with QuickBooks and is linked to the QuickBooks Cash business bank account.

Envelopes: Envelopes allow business owners to set aside money for specific planned or unexpected expenditures, helping to ensure that their future spend is not accidentally used. This means that small businesses can easily budget and directly partition funds into categories they will need to pay — for example, for quarterly taxes, employee bonuses or supplies and materials.

High-Yield Interest Rate: Small business banking accounts today offer zero to low interest rates, yet come with fees and minimum balance requirements. QuickBooks Cash, on the other hand, will offer customers a high-yield interest rate of 1%,6 — 25 times higher than the average rate of .04%4, on all balances.

Free Instant Deposit: With free instant deposit, small businesses no longer need to wait for incoming funds to clear when they’re processed through QuickBooks Payments. For eligible transactions, instant deposit will provide immediate access to funds from QuickBooks Payments in the QuickBooks Cash account — for free.

Cash Flow Planner: Powered by machine learning, the Cash Flow Planner within QuickBooks Cash provides a full view of a business’s finances via a dashboard that indicates how much money is coming into the business and how much money is going out. This end-to-end look analyzes all financial inputs to predict a business’s cash flow over the next 90 days, proactively alerting business owners when a cash flow concern might arise and providing recommendations for navigating the challenge.

Bill Pay: With bill pay available in QuickBooks Online, small businesses will be able to schedule vendor payments and manage all their money out transactions in one place. The transactions are recorded in QuickBooks, so their books are automatically reconciled.

Seamless QuickBooks Integrations: QuickBooks Cash seamlessly integrates across the QuickBooks Online platform, so small businesses can use the funds in their QuickBooks Cash account to run payroll, accept payments and send invoices — all of which are automatically reconciled and accounted for in their QuickBooks file for a complete money-in and money-out view.

If you are interested in learning more, click here for their QuickBooks Cash landing page.